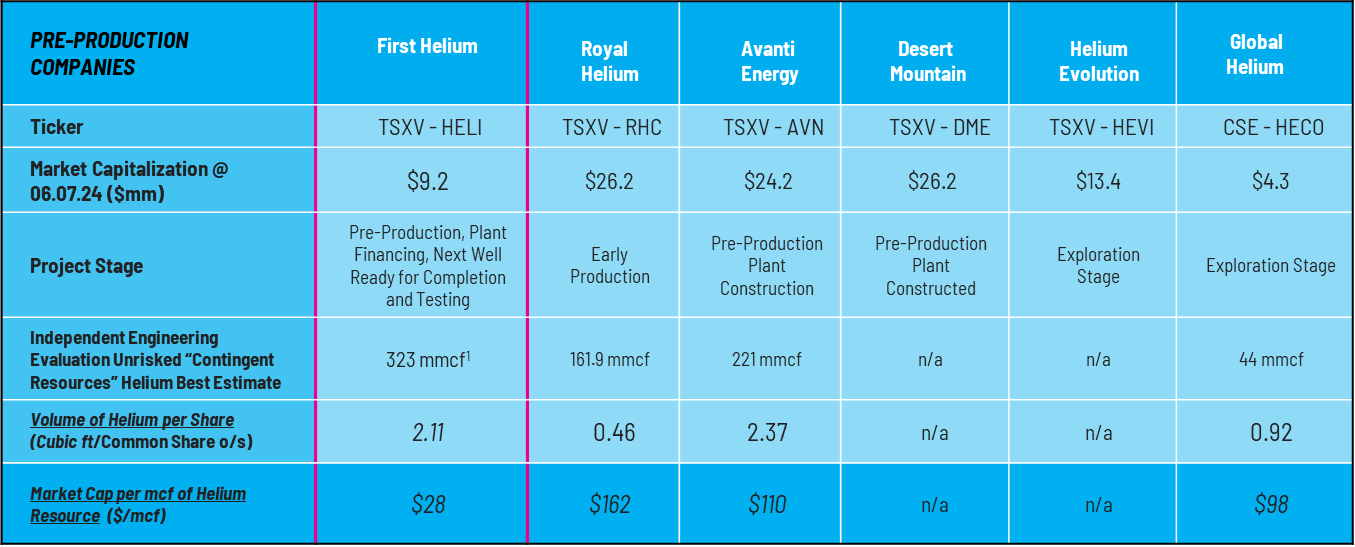

First Helium Inc. – An exploration company with a helium discovery well that is being brought into production together with near term catalysts to significantly expand helium resource and project scalability, along with lower risk oil development opportunities to provide operating cash flow. First Helium is planning to complete and test a previously drilled horizontal helium target well, and drill one high impact exploration target well for natural gas with associated helium, or oil in H2-2024.

Exploration & Development Upside

First Helium is currently focused on exploring its high-quality project at Worsley:

- 53,000 Acres on Core Project, 100%-Owned, multi-zone drilling for natural gas with associated helium, and light oil

- Peer-group-leading helium resource, independently evaluated by Sproule

- Securing helium plant financing to bring helium Discovery Well into production to generate cash flow for growth

- Large inventory of drilling locations identified in two zones provides path to becoming meaningful helium supplier

- Ten-year (first 5 years firm pricing), take-or-pay helium offtake sales agreement, with 20% volume availability for direct/alternative sales strategies

- A number of lower risk oil development opportunities to bolster cash flow.

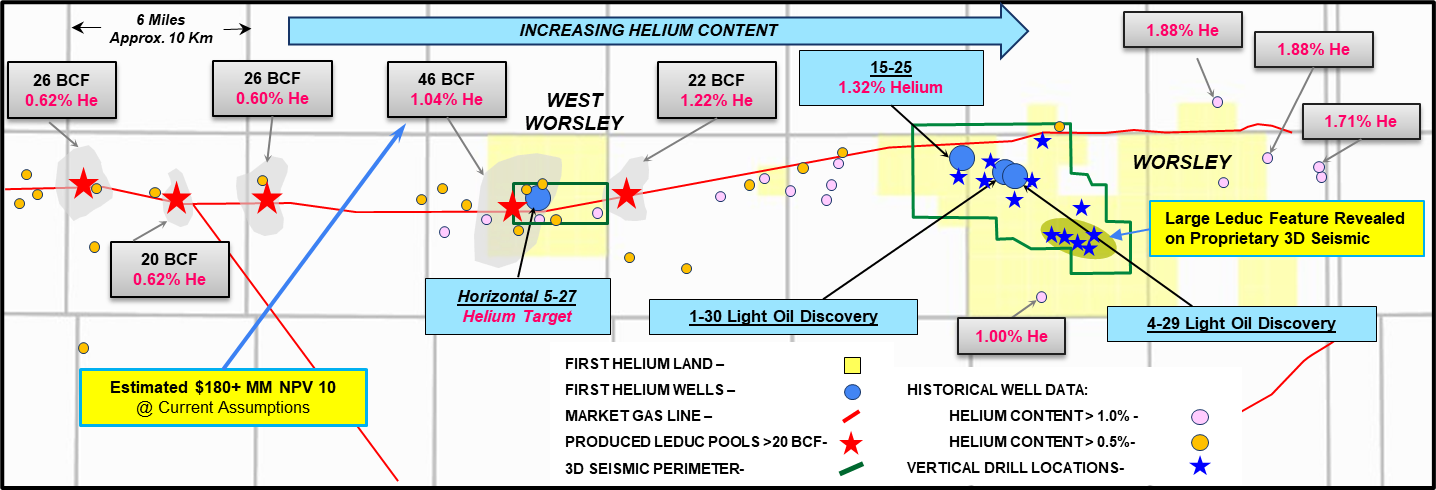

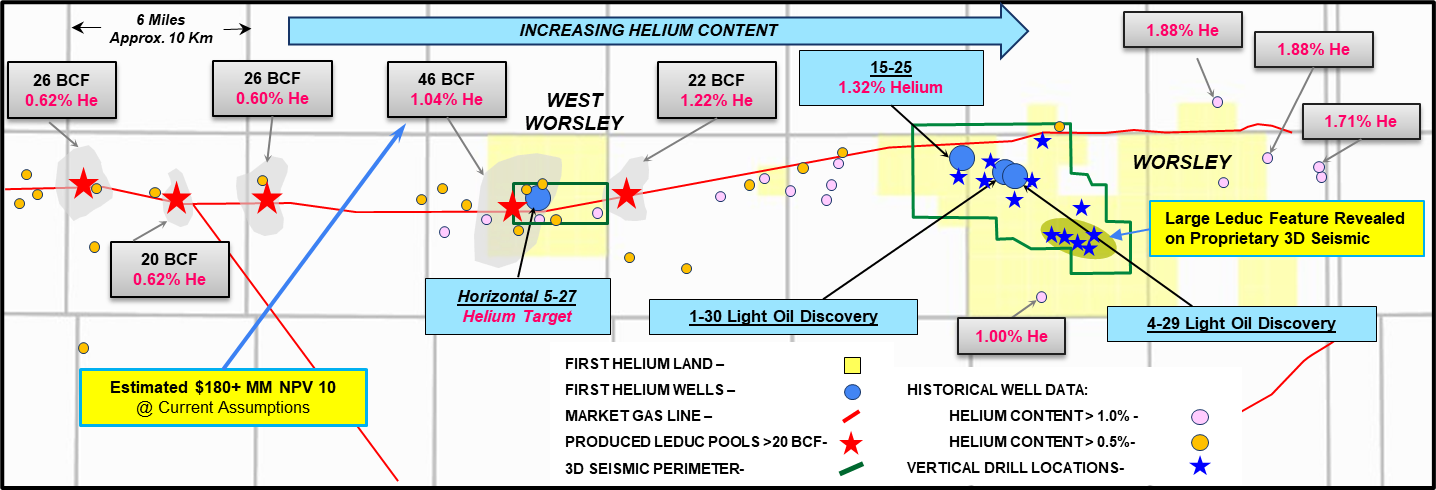

The Discovery Well (“15-25”) has tested 1.3% helium content and 65% natural gas content, which is very economic and ready to be brought into production. The Company has entered into a long-term offtake helium sales agreement with a large global industrial gas distributor. Twelve vertical drill locations in the Leduc zone along with a potential regional, repeatable horizontal drilling play in the Blueridge zone provide visibility on significant helium project scalability. New successful light oil wells can be brought into production in short order for minimal cost given the Company’s existing oil battery facility at Worsley.

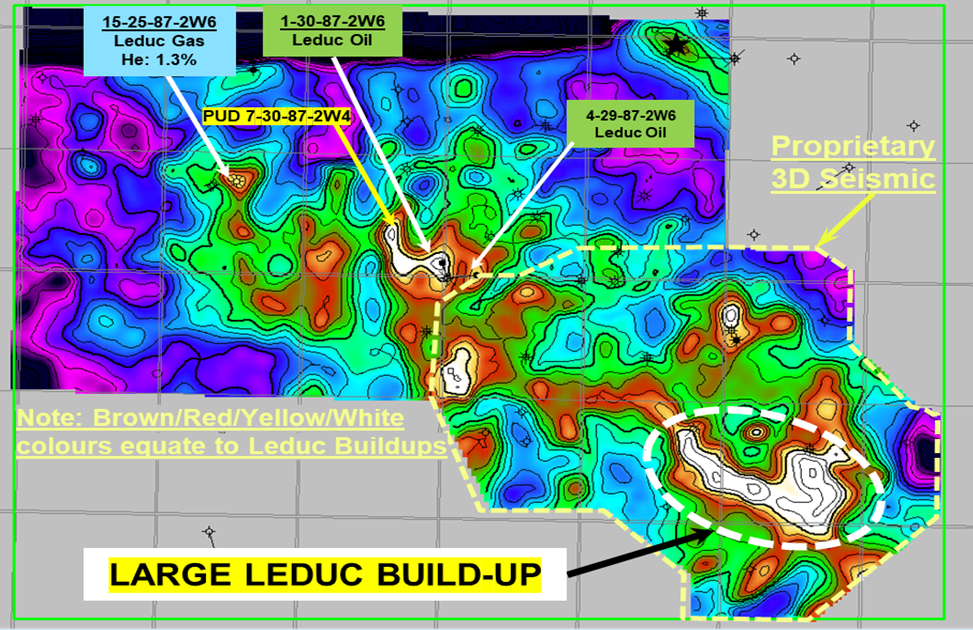

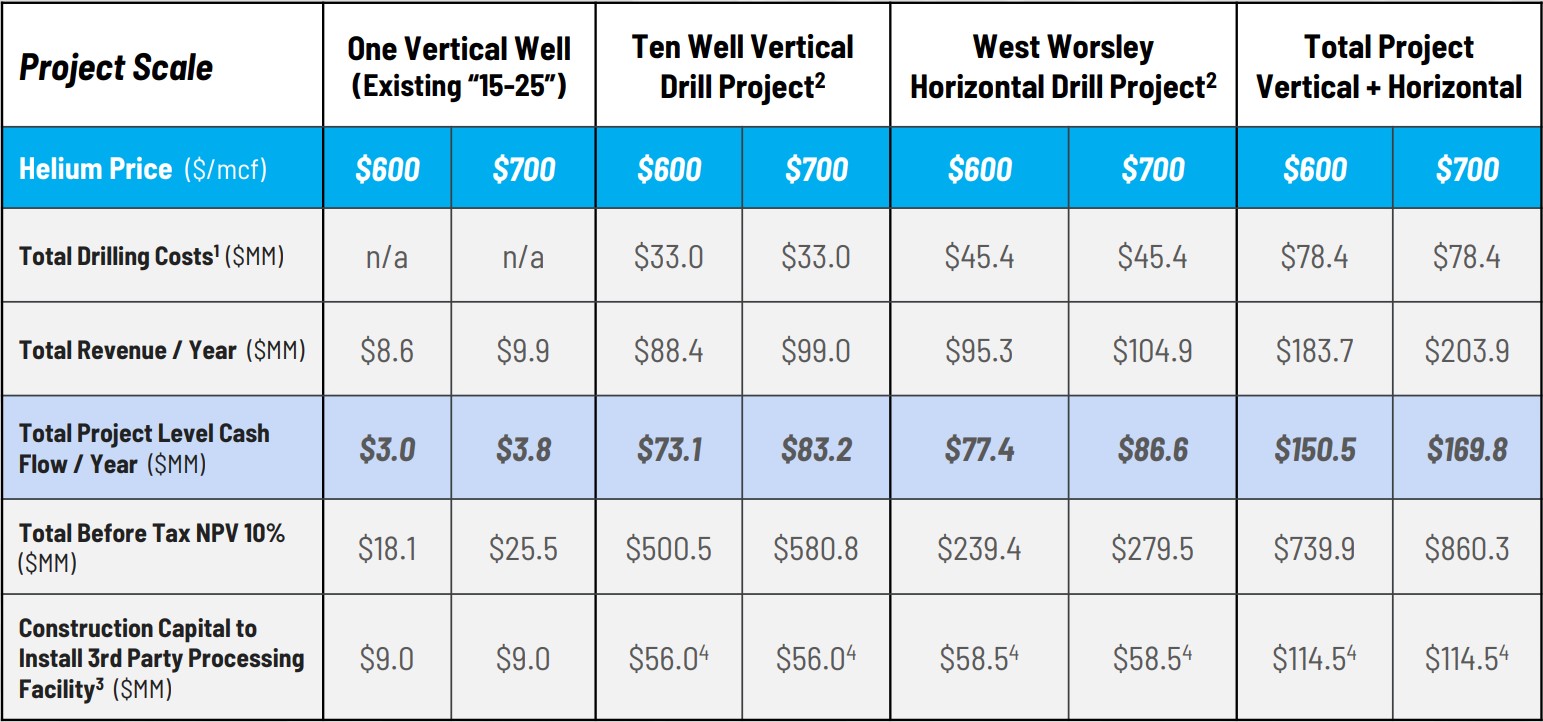

Figure 1: First Helium Worsley Proprietary 3D Seismic Leduc Interpretation

Drilling this structure, like the previous two Leduc oil wells drilled by the Company, has the potential to encounter multiple productive horizons (pay zones) which can include light oil and natural gas with associated helium. First Helium will be focused on evaluating and testing this significant structural target in the coming months. Success on a structure of this magnitude will allow First Helium optionality to create a second operating hub, a multi-well facility which will reduce operating costs and expand our operating base further eastward on our core lands.

Highlights of Planned Activities for H2 2024

The Company plans to test multiple high impact exploration targets over the next 6 months, including:

- A substantial structure in the Leduc Formation, identified on recently interpreted proprietary 3D seismic (Press Release dated July 3, 2024); and

- Numerous planned horizontal, helium-enriched natural gas targets on a regional play on the western part of the Worsley property.

All targets to be tested in the anticipated program:

- Have the potential to encounter multiple productive horizons (pay zones) which can include natural gas with associated helium, and light oil;

- Are located on trend and adjacent to past producing helium-enriched natural gas pools and light oil wells (See Figure 1);

- Can garner premium pricing, with netbacks ranging from 3 - 4 times the netbacks of conventional natural gas, when enriched with helium; and

- have an offtake agreement in place with one of the largest global helium gas distributors.

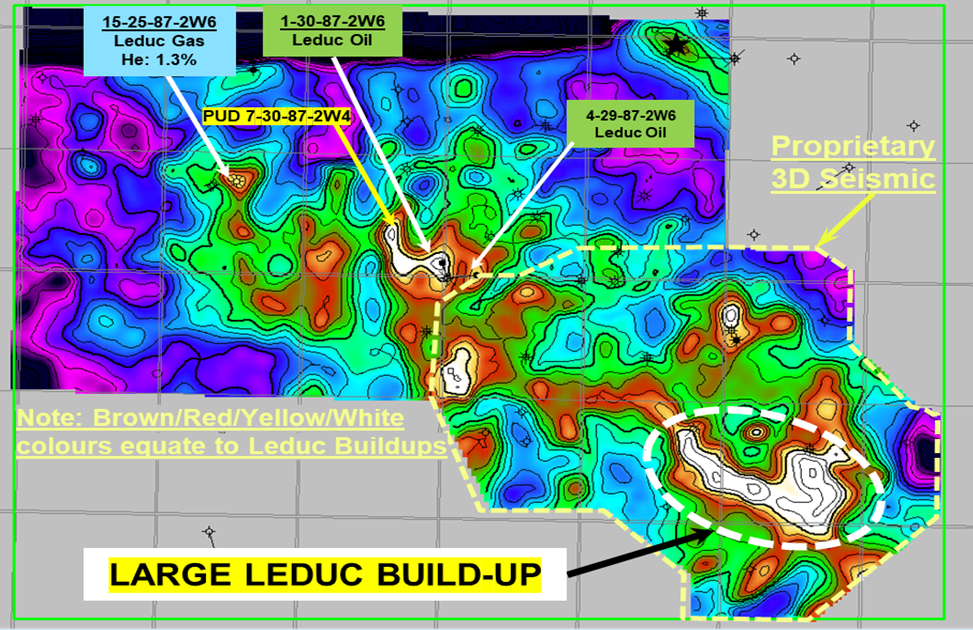

Figure 2: Worsley Project

“Over the past several months, our team has been working to complete the evaluation of proprietary 3D seismic data over our 100% owned Worsley property. We recently reported that we have identified a large structure in the Leduc Formation that is on trend and substantially greater in areal extent than our 1-30 Leduc oil pool discovery, which together with our 4-29 Leduc well, have produced 113,000 barrels of light oil and generated $13 million in revenue to date,” said Ed Bereznicki, President & CEO of First Helium. “In the coming months we plan to test that large Leduc structure as well as complete a horizontal well previously drilled in the Blueridge Formation on the western part of the property. Successful completion and testing of that horizontal well could help establish a regional, repeatable natural gas play with scalability and tremendous potential for growth as well as enriched netback economics resulting from the helium content of those wells,” added Mr. Bereznicki.

The Company’s Worsley Property encompasses more than 53,000 acres of 100% owned land along a trend of sizeable, past producing helium enriched natural gas pools (See Figure 1). This includes the 15-25 helium discovery well, with an independently evaluated resource of 323 million cubic feet of helium1,2, along with numerous multi-zone targets for helium, oil, and natural gas.

The Company has established several key priorities over the next three to six months to advance the Worsley project area, including:

- Drilling the newly identified large Leduc feature - A successful oil well would be tied into existing infrastructure and brought into production in approximately 3 - 4 months. The Company would plan to bring a successful natural gas with associated helium well into production in conjunction with First Helium’s 15 – 25 helium discovery;

- Completing and testing the drilled, 100% owned 5-27 horizontal helium well at West Worsley - A successful test will establish a large, repeatable natural gas play with associated helium content that will generate significantly increased cash netbacks when compared to a typical natural gas play. The project’s potential scale and enhanced profitability will serve to attract partnership opportunities; and

- Re-entering and completing an existing vertical well bore to potentially expand our regional play, enabling further project growth and scalability.